Top Story

ULI and LaSalle Launch Latest Decision-Making Framework for Real Estate Industry to Assess Physical Climate Risk

Step-by-step framework to evaluate physical and financial risk and compare cost and benefits of resilience

May 21, 2024

TOKYO, 21 MAY 2024 — The 2024 Asia Pacific Home Attainability Index by the Urban Land Institute (ULI) offers a comprehensive overview of housing attainability across the Asia Pacific region. In this third edition, the report includes data from three additional cities – Bangkok, Kuala Lumpur, and Perth, expanding its coverage to 48 cities in 11 countries, namely, Australia, China (including Hong Kong SAR), India, Indonesia, Japan, Malaysia, Singapore, South Korea, the Philippines, Thailand, and Vietnam.

Alan Beebe, CEO, ULI Asia Pacific, said: “In addition to measuring home attainability for both home ownership and rentals in relation to median household income across 48 cities, the report has also identified key trends and factors affecting home attainability in the Asia Pacific region, which represents 60% of the world with a population of 4.3 billion people. By identifying key factors impacting housing supply and demand, we can work towards advancing best practices in residential development and to support ULI members and local communities in creating more equitable housing opportunities for all, aligned to our goal at the ULI Asia Pacific Centre for Housing.”

2024 ULI Asia Pacific Home Attainability Index Key Trends:

1. In cities experiencing significant immigration inflows, home price and rent have risen materially.

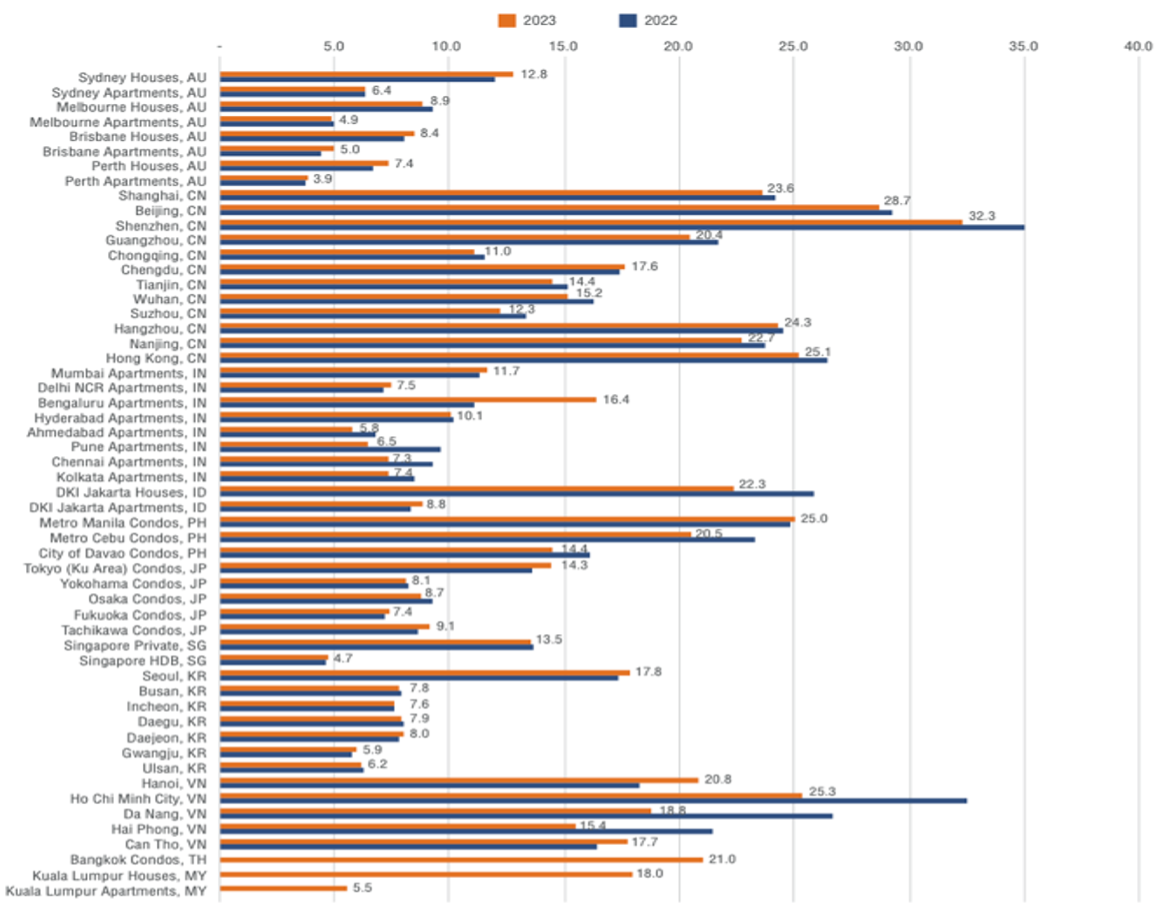

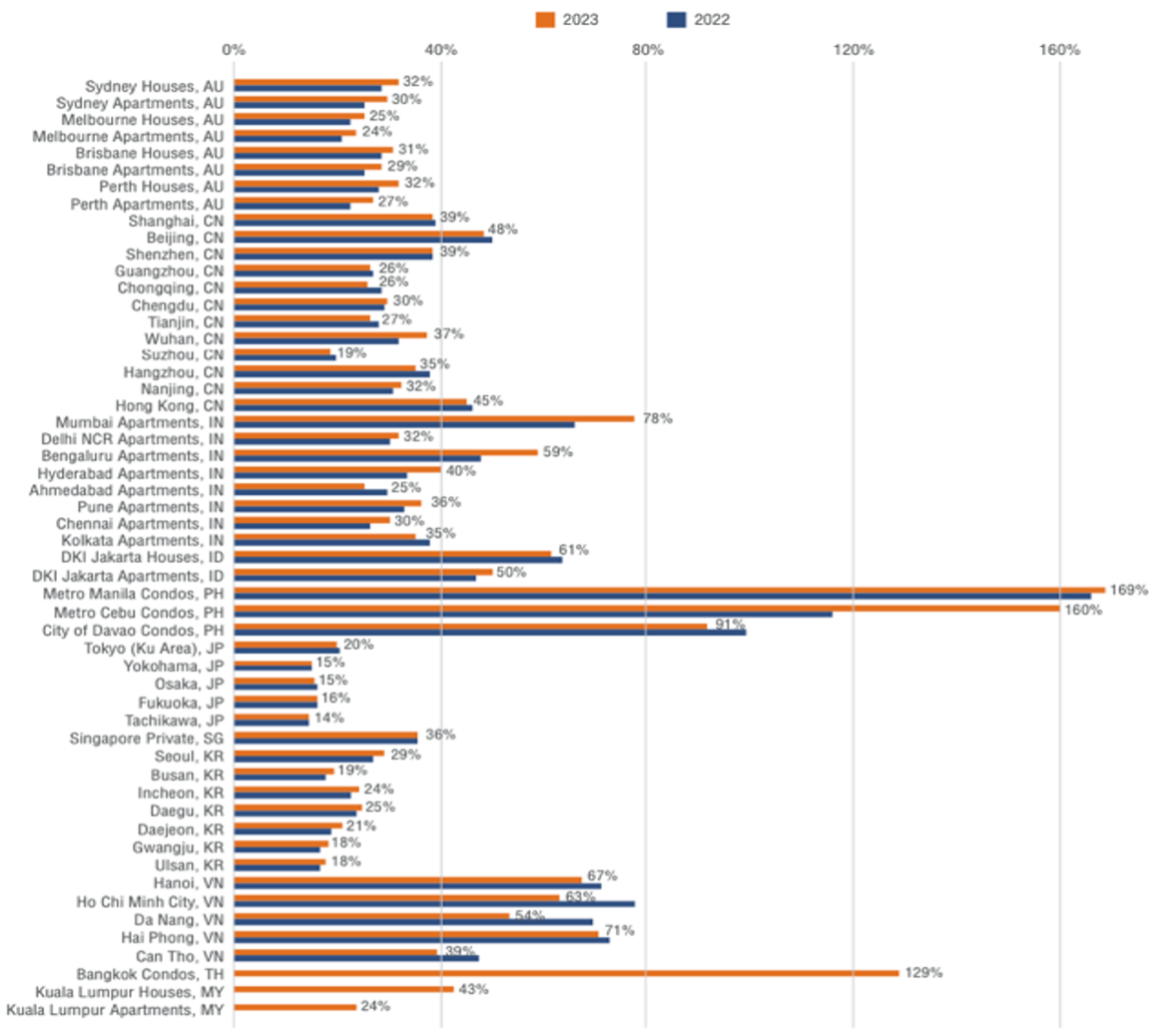

Popular gateway cities for overseas immigration and studies, such as Singapore, Sydney, and Tokyo, have recorded steep hikes in home prices due to a large influx of immigrants, while key Australian cities including Sydney and Melbourne saw increases in rental rates due to falling vacancy rates of 0.9% and 2.2%, respectively.

Tokyo’s urban core area consisting of 23 wards has seen its new condominium prices rise by nearly 40%, caused by an increase in foreign buyers, primarily from mainland China and the relatively inexpensive prices for a global gateway city. For comparison, even after the price increase, the median price of a new condominium in Tokyo is US$800,000, considerably lower than the median price of over US$1 million for new units in similar urban cores of Tier 1 cities in China such as Shenzhen, Shanghai, and Beijing. As a result, Tokyo has emerged as an attractive choice for mainland Chinese looking to buy a property outside of China.

To curb private home prices, Singapore introduced a 60% stamp duty on foreign buyers of private homes, contributing to a 20% drop in total home sales.

2. High home prices and rent levels have negatively impacted home attainability for young people in their twenties and thirties. To alleviate housing shortage and improve home attainability, some national governments are promoting for-rent developments.

At the current price levels, young people in their twenties and thirties living in leading economic centres, especially first-generation young migrants, have little hope of being able to afford a home. This is unless they come from generational wealth or belong to a small minority of otherwise wealthy individuals.

As an example, Bangkok’s median condo price of around US$224,000 is 21 times the median annual household income, while median monthly rent of US$1,150 represents 129% of median monthly income. In Bengaluru, the return of IT professionals into India’s IT hub following the end of COVID-19 drove the ratio of median home price to median annual household income to 16.4 from 11.1 in the previous year.

To alleviate housing shortage and improve home attainability, countries and investors are pivoting towards promoting for-rent projects to increase the supply of affordable homes. Australia’s new Labour Party government adopted a housing policy that includes an AU$10 billion (approx. US$6.5 billion) Housing Australia Fund to fund 30,000 new social and affordable rental homes in five years, as well as tax incentives for the development of build-to-rent homes in the private market.

In Singapore, where housing policy is centred on home ownership, the government has recently sold a plot of land with a requirement for large-scale, long-term rental units. This unusual move was made after the Urban Redevelopment Authority (URA) determined that there is sufficient demand for long-term rental housing, especially among young professionals, students, and families in transition, following consultations with the industry.

3. Home buyers and renters are forced to take on financial risks, such as loss of deposits or not receiving their completed homes on time, as home builders and landlords get into financial distress which impact project completions.

In mainland China, sluggish sales and escalating costs in the past two years have caused many leading home developers to incur unprecedented losses and default on loans. Given that pre-sale of homes before construction is customary in mainland China, buyers of such homes still under construction are placed in a precarious position where they run the risk of not receiving their completed homes on time.

In Australia, in the past two years, over 2,000 home builders went out of business largely due to rising interest rates, building materials and labour costs. Homeowners face substantial financial risk such as not being able to recover deposits or not having the home constructed as agreed.

In Vietnam, many developments have come to a standstill as developers failed to meet interest payments, a situation further exacerbated by the credit crunch spurred by declining bond issuance and a general market turmoil that impacted developers’ liquidity. While the Vietnamese government has implemented countermeasures such as reducing mortgage rates, a new Land Law that emphasises market-driven land valuation could significantly increase the costs of acquiring projects.

Beebe added: “The housing market has been significantly affected by heightened interest rates and rising costs. Home ownership represents the most valuable asset for most households, and the housing sector is a key part of the overall economy. Moving forward, we expect to see governments in the region introduce more countermeasures to rein in rising home prices.”

Other key findings and metrics from the report include:

In this report, home attainability is measured by (i) median home price to median annual household income, ideally less than 5 times, and (ii) median monthly rent to median monthly household income, ideally less than 30%.

A complete list of the 10 key trends and insights identified by the 2024 Asia Pacific Home Attainability Index is available at this link. Analyses of home attainability by country are also available in the full report, which can be found on ULI’s Knowledge Finder platform.

# # #

NOTE TO EDITORS: High-res versions of the charts in the press release are available for viewing in the full 2024 ULI Asia Pacific Home Attainability Index. We also warmly invite you to attend the 2024 ULI Asia Pacific Summit, taking place in Tokyo from 27–30 May 2024. If you’d like to attend the Summit, please get in touch.

Media Contacts

For further information, please contact:

Priscilla Tong, Director, Communications, ULI Asia Pacific: [email protected]

Nurul Juhria Binte Kamal, Associate, Progressive Communications

[email protected] | +65 8779 1654

About the Urban Land Institute

The Urban Land Institute is a non-profit education and research institute supported by its members. Its mission is to shape the future of the built environment for transformative impact in communities worldwide. Established in 1936, the Institute has more than 48,000 members worldwide and over 3,000 members in the Asia Pacific region representing all aspects of land use and development disciplines. For more information on ULI Asia Pacific, please visit asia.uli.org, or follow us on LinkedIn, Facebook, Instagram, X, and YouTube.

About the ULI Asia Pacific Centre for Housing

Established in 2022, the ULI Asia Pacific Centre for Housing aims to advance best practices in residential development and support ULI members and local communities in creating and sustaining a full spectrum of housing opportunities. The Centre for Housing publishes the annual Asia Pacific Home Attainability Index.

The Centre for Housing acts as a think tank and provides a forum to explore the latest trends and to address housing issues relevant to the region. Our programme of work is delivered through events, research, education, and advisory services for government policymakers, developers, investors, occupiers, and communities at large.

Don’t have an account? Sign up for a ULI guest account.