Top Story

Submit Your Leader Profile

Submit your Leader Profile to be considered for high-impact sessions aligned with your expertise.

September 4, 2025

Vidyashree Unnikrishnan

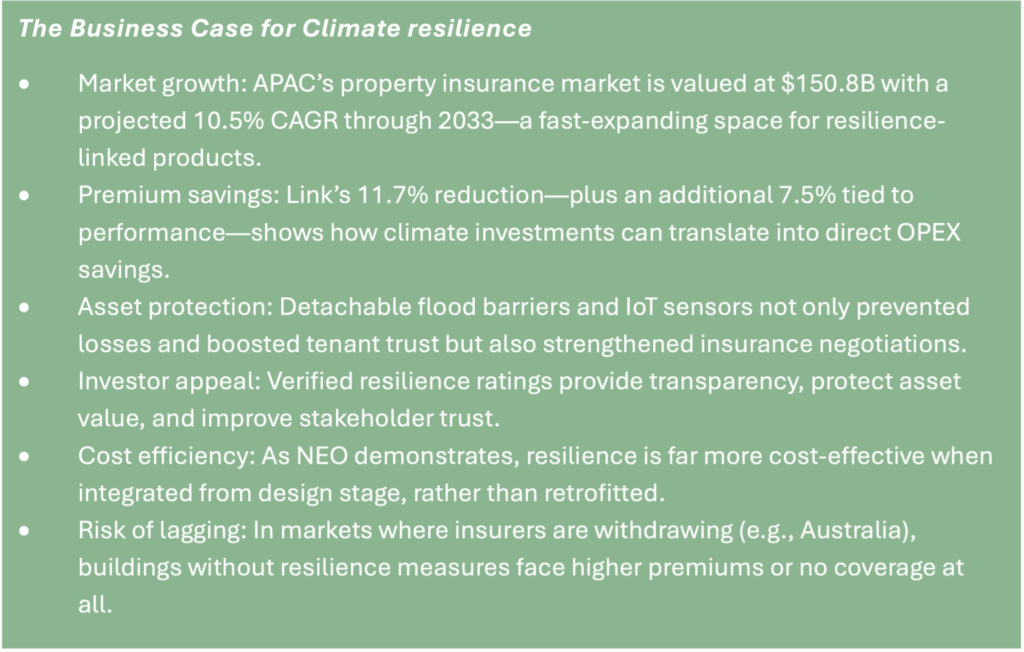

In September 2023, Hong Kong was hit by its heaviest rainfall on record — nearly 160mm in a single hour. Link Asset Management’s Temple Mall North, like many other buildings, suffered severe flood damage[LB1] . In response, the company invested in detachable flood barriers and Internet-of-Things (IoT) sensors to mitigate future risk. For Link’s bottom line, this resilience investment translated into an 11.7% reduction in insurance premiums.

Meanwhile, in Manila, NEO’s buildings weathered yet another typhoon season with their 250kph wind-rated design— significantly above the required 200kph minimum. Despite this superior resilience and an A+ climate rating according to the Building Resilience Index (BRI), NEO pays the same insurance premiums as buildings that barely meet basic codes.

This tale of two developers illustrates a fundamental shift happening across Asia-Pacific. Climate phenomena are intensifying in both impact and unpredictability, forcing developers to confront a harsh reality: they can no longer simply absorb higher premiums for climate-exposed buildings. In extreme cases, such as parts of Queensland and New South Wales that have experienced repeated flooding and bushfires, insurers are cancelling polices. As tools like the Building Resilience Index (BRI) become more accurate and widely adopted, partnerships like the recent International Finance Corporation – QBE Insurance collaboration are finally creating systematic ways to quantify physical climate risk assessments and translate resilience investments into measurable value protection and ROIs such as insurance underwriting benefits.

Resilience is no longer a ‘nice-to-have’ in the property sector, it’s the quiet deal-breaker shaping investments, operations, and community trust. In the Asia-Pacific region, where physical climate risks are rising faster than the playbooks to address them, the leaders worth watching aren’t the ones with the biggest budgets- they’re the ones making uncomfortable, operational changes today.

Enter the Building Resilience Index

The Building Resilience Index, developed by the International Finance Corporation, evaluates how well buildings can withstand climate hazards specific to their location and recover from them. Unlike green building certifications focused on operational sustainability, BRI uses a location-specific approach that maps actual hazard risks for each site. Buildings receive letter grades (Figure 1) based on their ability to withstand local hazards like typhoons, floods, and earthquakes.

The assessment is questionnaire-driven, making it accessible to developers of all sizes while remaining robust enough to satisfy insurer requirements. BRI launched as a pilot in the Philippines in 2020 and has since expanded across East Asia, the Pacific, South Asia, and Latin America.

The NEO approach: Resilience is an independent priority

NEO Philippines exemplifies how developers can integrate climate resilience from the ground up. As Gie Garcia, the company’s Co-Managing Director and Chief Sustainability Officer, explains, NEO has consistently built beyond minimum requirements. “When we built our building, there’s a standard building code, right? But we go beyond the building code at least 5% more than the standard,” Garcia says.

This approach proved advantageous when NEO participated in the 2020 BRI pilot. With comprehensive documentation and original construction certifications already in place, the assessment process was straightforward. “It was very fast when we did the pilot, because all of these files are with us,” Garcia notes. The company achieved an A+ rating without any retrofits, demonstrating how upfront planning can streamline resilience validation.

However, this achievement highlights a persistent industry gap. Despite their A+ rating and superior resilience specifications, NEO receives no insurance premium benefits. “Even if you’re green, you’re resilient, you have all these certifications, you are treated standard, the same as the rest,” Garcia explains.

The challenge reflects broader market dynamics in the Philippines, where insurance policies typically involve multiple providers due to high coverage costs, making resilience-based negotiations complex. Yet NEO continues pursuing third-party validation. “For us at NEO, it’s about third-party validation. You don’t claim your building is resilient or green unless it’s been verified,” Garcia emphasizes.

This commitment to verified performance positions NEO advantageously for when insurance markets evolve, but highlights the current gap between resilience investment and financial recognition.

“Even if you’re green, you’re resilient, you have all these certifications, you are treated [as] standard, the same as the rest. So there’s no relaxation. You are treated the same premium as the rest.”

—Gie Garcia, CSO and Managing Partner, Neo

The Bridge: QBE-IFC Partnership Changes the Game

The June 2025 partnership between IFC and QBE Asia represents the first systematic attempt to bridge this gap. QBE is the first major insurer to formally integrate BRI assessments into underwriting processes, expanding the program beyond developers to include homebuyers, financial institutions, and governments.

The collaboration focuses on three key areas: stakeholder education through workshops in Hong Kong SAR, Malaysia, Singapore, and Vietnam; product innovation including parametric insurance solutions and risk-adjusted pricing models; and technical integration of QBE’s underwriting platforms with BRI’s risk assessment tools.

This partnership addresses exactly what NEO and other forward-thinking developers have been waiting for. Buildings with superior BRI ratings will qualify for “broader coverage options, risk-driven and sustainability-linked pricing, expedited claims processing, and parametric insurance solutions that provide rapid payouts based on predefined triggers” (IFC).

Although NEO’s experience highlights the frustration of building resilience without immediate financial reward, the QBE Insurance/IFC partnership illustrates how insurers are beginning to close that gap. But what happens when a developer pushes the conversation forward themselves?

That’s exactly what Link did. Their approach shows how collaboration with insurers can unlock measurable financial benefits today, offering a real-world blueprint for others in the region.

The Link blueprint: Partnering to make resilience bankable

Link’s success demonstrates what’s possible when insurers and developers collaborate directly. Through their partnership with AXA Hong Kong and Marsh, Link achieved an impressive 11.7% premium reduction—nearly four times the industry’s ~3% average. An additional 7.5% reduction (Link) tied to their loss ratio creates ongoing incentives for climate preparedness investments.

Their approach involved quantifying climate risk through comprehensive assessments, implementing targeted resilience measures like flood barriers and IoT sensors, and transparently communicating these investments to insurers. The result: a replicable blueprint that the QBE-IFC partnership aims to standardize across APAC.

The path forward

Taken together, accurate risk assessment tools, insurer recognition, and developer demand are converging into a new paradigm— one that makes climate resilience bankable. As of 2024, the region’s property insurance market was valued at $150.8 billion with a projected CAGR of 10.5% till 2033 (Cognitive Market Research) providing significant opportunity for resilience-linked products.

What makes this shift particularly promising is how accessible these tools are becoming. BRI’s questionnaire-based approach works for developers of all sizes, not just region and class specific portfolios like NEO’s. As Garcia emphasizes, “Resilience is far more cost-effective when integrated at the outset, rather than added later through retrofits” demonstrating that the integration of climate risk mitigation strategies during the early design and planning phases can substantially reduce marginal costs and improve long-term project efficiency.

The next wave of resilience in APAC will come from imperfect, in-progress attempts that we can learn from and adapt. The tools exist, insurers are ready to engage, and the financial case is becoming clear. But here’s the uncomfortable reality: while some developers are still debating whether climate resilience is worth the investment, others are already negotiating lower premiums and positioning themselves as preferred partners for forward-thinking insurers. In a region where climate risks are escalating faster than traditional risk models can adapt, can your portfolio afford to be the last one to move?

Resilience Tools and Resources

Investment Strategy Guidance:

Climate Risk and Real Estate Investment Decision-Making

Climate Risk and Real Estate: Emerging Practices for Market Assessment

Physical Climate Risks and Underwriting Practices in Assets and Portfolios

Assessment tools & resources:

How to Choose Use and Better Understand Climate Risk Analytics

10 questions to Ask Climate-Risk Analytics Providers

Risk Reduction Resources:

ULI Developing Resilience Toolkit

CRE Guide to Natural Hazards and Property Insurance Underwriting

Find more reports and resources on ULI Knowledge Finder

Cognitive Market Research. (n.d.). Asia Pacific Property Insurance Market Report 2025.

IFC. (n.d.). IFC and QBE Insurance Team Up to Drive Building Resilience in Asia Pacific, 2025.

With thanks to Gie Garcia NEO Office PH and Woody Chan Link for insights and examples.

Building Resilience Index IFC – International Finance Corporation QBE Asia

Don’t have an account? Sign up for a ULI guest account.